Carriers are facing increasing financial pressure in the trucking industry; these challenges can make long-term success difficult without strategic support. Low freight rates, high fuel costs, payment delays, insurance premium increases, and regulatory costs can all add to the burden of being a business owner. Keep reading to learn how to keep your business booming with the help of Porter Freight Funding.

Jump To Section

Get To Know Porter Freight Funding and What Makes Us Different

Porter Freight Funding was formed in 2011 when Porter Capital Corporation acquired an experienced transportation factoring company. Porter Freight Funding is headquartered in Birmingham, AL, with offices located in Hartselle, AL, and Flower Mound, TX.

There are endless amounts of freight factoring companies across the United States, but not all of them have your back like we do. You deserve the best for your trucking company, and that’s exactly what we are. Whether you have 1 truck or 100 trucks, we adapt to your volume and needs.

From day one, you’re paired with a real human; not a call center, not a chatbot. Your dedicated Account Executive knows your name, your business, and exactly how to keep your cash flowing. No phone trees, no hold music; just straight answers and fast solutions from someone who’s got your back. We also have a vast Porter Partner Network, consisting of a variety of dispatchers, insurance agents, trailer leasing companies, etc., to get you connected to the support you need most.

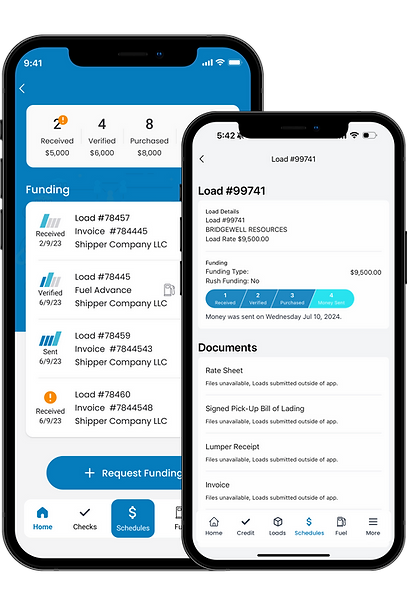

“Carriers come to us for funding, but they stay because we show up like a true business partner — offering support, solutions, and a team fully committed to their success. At Porter, we’re more than just a funding provider. We help carriers grow through expedited payments, a user-friendly mobile app, fuel discounts, and more.” – John Land, President

The Porter Freight Account Resolution Team (ART) is an integral part of the overall Porter Risk Management Program. They are responsible for daily monitoring, assessment and resolving at-risk debtor accounts. They provide escalated account resolution measures in support of collecting default accounts, while minimizing a client buyback. This team works for YOU to help recover the payments you deserve.

Tired of overpaying at the pump? With the Porter Fuel card, you can start saving up to $1.20 per gallon on every fill-up and every mile. We set out to build a program that is a REAL cost saver, offering discounts on lower priced fuel to drive bottom line results versus adding a discount to a gallon that is already over-priced just to show “savings”. It’s not just a discount — it’s a smarter, simpler way to fuel your fleet.

You can forget juggling receipts or chasing down reimbursements. Our fuel card takes the stress out of fueling, so you and your drivers can stay focused on the road ahead; with confidence and convenience in your pocket. These savings can add up to HUNDREDS of dollars a month. What more could you do for your company with this extra cash?

Need help upfront? We’ve got your back with fuel advances up to 50% of the load. We’ll load the funds directly onto your Porter Fuel Card, so your rig is always ready to roll, whether you’re heading home or hauling to the next drop. Fuel advances are offered to assist our clients in offsetting the costs of expensive broker quick pay options, which in turn also impacts their negotiating power with the broker. Brokers assume the carrier is desperate for cash, so they can offer a lower rate from the start.

At Porter Freight Funding, we don’t just help you move freight — we help move your business forward.

What is Freight Factoring?

Let’s face it — waiting 30, 60, or even 90 days to get paid slows you down. That’s where freight factoring comes in. At Porter Freight Funding, we turn your delivered loads into same-day cash, so you can keep your wheels turning and your business growing.

How the Freight Factoring Process Works:

- You haul the load and send in your paperwork (like a signed bill of lading and rate confirmation).

- We buy your invoice and advance 96–98% of the cash to you, usually within 24 hours.

- We collect from the broker or shipper, so you don’t have to wait around or chase payments.

Boom. Money in your account. No more stress, no more slow-paying customers.

Do you want even more peace of mind? We’ll check your brokers’ credit before you haul, so you can protect your time, your fuel, and your bottom line.

Have You Ever Been in These Situations? Here’s How We Can Help!

SITUATION: A small fleet delivers a load worth $4,500. The broker has a 45-day payment window. Meanwhile, the carrier has payroll, fuel, and insurance premiums due next week.

How Porter Freight Helps: Porter advances 96-98% of the invoice amount within 24 hours; which turns waiting weeks into cash in hand today. The fleet stays on the road.

SITUATION: An owner-operator books a long haul from Texas to Illinois. It’s a profitable load, but they don’t have enough cash on hand for the upfront fuel cost.

How Porter Freight Helps: Porter Freight Funding offers fuel advances , so the driver can get on the road without draining their last dollar.

SITUATION: A carrier hauls a load, delivers on time, submits all paperwork—and then never hears back from the broker. Emails go unanswered, and payment is overdue. You’re eventually told that the load is discovered to have been double brokered. Now what?

How Porter Freight Helps: Porter’s Account Resolutions Team (ART) will contact the shipper for payment, if the load was factored. For example, let’s say your company ran a $9,000 load, which turns out to be double brokered. ART would investigate to reveal the true carrier of record and ask them for payment. In this case, the carrier of record was going to pay $5,600 to the carrier of hire, who double brokered the load. ART negotiated with the carrier of record to recover $5,600 for our client. In any other case the client would have lost all $9,000 from the invoice, compared to the $3,400 we would not be able to recover. We were able to recover 70% of their payment! That’s what makes Porter different.

SITUATION: A carrier with a new MC number finds it hard to avoid fraudulent loads and non-paying brokers.

How Porter Freight Helps: New MCs are often targets for scams, fake loads, and shady brokers who don’t pay. Porter Freight Funding helps protect new carriers from these risks with tools and support that build confidence on the road. Every client gets access to broker credit checks, helping you verify payment history before you ever haul a load. Porter’s experienced team also flags suspicious documents and verifies broker legitimacy. With back-office support and collections included, Porter acts like a safety net, so you can focus on moving freight. While these actions won’t prevent fraudulent loads from occurring; we can minimize the impact if the resulting load is fraudulent.

Busting Common Myths About Factoring

“Factoring means I’ve failed.”

It’s absolutely not true! We recognize that some traditional truckers may be cautious about factoring. It’s often seen as a last resort or an unnecessary expense. Experts concur that 70% of fleets that don’t use factoring services will go out of business within the first year. Business owners rely on factors to increase cash flow. It gives you tools to protect your income: run credit checks on brokers, guard against non-payment, and lean on a dedicated collections team if a broker delays or defaults. If you’ve ever hauled a load and waited weeks (or even months) for payment, you understand how damaging that can be to your cash flow. Waiting to get paid is the #1 reason for business failure within the transportation industry. With Porter Freight, you have experts on your side that are there to support you. Freight factoring can greatly reduce your cash flow concerns.

“Factoring is too expensive.”

Paying a fee for a service can be expensive but not having an essential service can also be expensive. It makes sense to watch every dollar spent on your company. The real cost isn’t the factoring fee; it’s the downtime and stress caused by waiting 30–90 days to get paid. Using a factor’s credit check tool will often prevent broker fraud. Which, ultimately, would cost more than any freight factoring fee. This one non-payment event could easily outweigh the cost of freight factoring due to fuel, lost legal fees, time, anxiety, and stress possibly putting a new carrier out of business.

For example, if your company hauls a $1,200 load, you’re paying for fuel, drivers, dispatching, and insurance premiums. You’re handling all tasks to make sure the load gets delivered on time. After all that time and effort, how would you handle an unresponsive broker refusing to pay? You’re not just losing $1,200; it ends up being more in time and money. For a small factoring fee of around $30 (2-4% of the invoice), we make sure that you can get the money back that you deserve. Budgeting $30 is a lot easier than navigating a larger unexpected loss.

“Only a new MC needs factoring”

Even established fleets benefit from factoring. Hiring a factoring company for credit checks, invoicing, collections, and account resolution is often more cost-effective than maintaining in-house staff. It also reduces administrative burden, allowing carriers to focus on operations, growth and revenue producing activities. Delayed broker/shipper payments remain a challenge, regardless of fleet size or tenure. Porter offers tailored factoring solutions, not one-size-fits-all contracts. We allow carriers to run credit checks prior to accepting the load, helping carriers avoid slow payers and fraud. In uncertain markets—especially those impacted by tariffs—many fleets rely more heavily on their factoring partner. During peak season, factoring provides the working capital needed for equipment, rising insurance premiums or general business expenses. In slower months, it helps maintain consistent cash flow to keep trucks moving effortlessly.

“Factoring means I’ll lose control of my business”

Actually, factoring gives you more control, not less. You get predictable, fast cash flow without relying on when a broker or shipper decides to pay. That means you can choose your next load based on strategy, not desperation. You control your money, your moves, and your growth. We don’t take over your business decisions; we provide back-office support. You still book your own loads, choose your own routes, and manage your operations. We’re simply the back-office partner working behind the scenes to ensure you get paid quickly. You’ll have access to tools like fuel advances and won’t have to chase down a broker, shipper, or bond company for your money.

Don’t Just Take Our Word for It, Hear it Directly from Our Clients

4.8 Stars on Google

“Our experience with Porter Freight Funding has been nothing short of exceptional! From the very beginning, their team has been professional, responsive, and incredibly helpful. The funding process is seamless, with quick approvals and fast payments that keep our business running smoothly.

What truly sets them apart is their outstanding customer service. They take the time to answer any questions, provide clear communication, and ensure we have the support we need. It’s rare to find a company that genuinely cares about its clients, but Porter Freight Funding does just that.

If you’re looking for a reliable and trustworthy freight factoring partner, look no further. Highly recommended!”

“Noah at Porter Freight Funding went above and beyond! Friendly, helpful, knowledgeable, and just a pleasure to work with! Thank you Noah for all your professionalism and help!”

“Well, I don’t post often, but this time it’s necessary. I just had an amazing experience while speaking with Arnellie Vargas at Porter Freight Funding. She was friendly, professional, and more than helpful. Thank you Arnellie!”

“My experience with Luis from PORTER FREIGHT FUNDING has been excellent, he has helped me in all the operations of RMA EXPRESS LLC, who from the beginning have been very professional, responsive and incredible in the financing and payment process, extremely fast and efficient. Recommended for all transport companies, without a doubt, do not hesitate to contact them.”

“Ms Aimee Phillips is without question one of my favorite people to deal with on a daily basis. I’m not really the one to leave reviews but when it’s earned and deserved, I will absolutely take the time and give that credit where it’s due. She is absolutely pleasant. She’s about her business,

she honors and never failed on her word. I wish I was over exaggerating, but that’s my experience with her. When I’m wrong, she lets me know with Grace and she corrects any corrections I need done. The only issue I ever have with her and she is entitled and that’s when she goes on vacation lol… For me, she’s been an attribute to my business and represents Porter Freight To the utmost.”

“Porter Freight Funding has been a reliable partner in helping Robert Hill & Sons Transport’s operations since 2021. The services go beyond factoring as we have utilized fuel cards and now their new Tank Card for quick funding. I personally work with Heather Harris and Amanda Duffy each day and they are not only knowledgeable, but very personable as well. Any time I call Porter with a challenge pertaining to a customer, they provide a solution that keeps our billing flowing. Thank you to the Porter Team!”

“I’ve had the pleasure of working with Brenda for over a year now, I love the relationship we have built! They are always just a phone call or email away, I look forward to many more years of networking together!”

“This company is the best company. They are the best factoring company. If you have a question, they will help you out and I work with Stephen. He is the best helper. I work with Stephen, and every time I call, he will help me answer any question I have or recommend what I need. I recommend any truck owner operator companies that use factoring to work with Stephen Hammons. I will give above 10 stars”

“As a small business owner, I rely daily on Porter Freight Funding. Porter Freight Funding has played an integral role in the financial success of my business. The Porter Freight Funding team gets 5 stars because of their service. The request for invoice purchases are processed quickly and seamlessly. Also, my account representative, Brianna Chaney is knowledgeable, pleasant and respectful. Brianna promptly returns my phone calls and emails and if she is not available, the other staff members are always willing to help. If you are looking for factoring company, I highly recommend Porter Freight Funding.”

Getting Started is Simple!

Apply now on our website or call our sales line at (205) 397-0934. For Spanish-speaking clients, we have a Spanish-speaking sales line at (205) 208-8285.

Summary

- Freight factoring (also known as invoice factoring) is a financial service that helps trucking companies and owner-operators get paid faster for completed loads.

- Factoring is a strategic move, not a last resort.

- You control your money, your moves, and your growth. We don’t take over your business decisions; we support them

- Apply now on our website or call our sales line at (205) 397-0934.

- Porter Freight Funding is more than a financial service; we are a trusted partner to help your business succeed!

Ready to strengthen your cash flow and grow your trucking business?

Get in touch with our team today and see how Porter Freight Funding can help you move forward with confidence.

By Julia S.