Get Insurance for Your Trucking Company

Commercial truck insurance for owner operators is a specific insurance policy to cover trucking needs. Most trucking insurance policies start with primary liability, with the option to add additional coverage options. Purchasing commercial vehicle insurance is often required to obtain a trucking license as it protects people and property from any damage trucks in your fleet may cause.

Call Us Today

205.397.0934

Types of Trucking Insurance

Insurance is one of the largest fixed expenses that a trucking company will face. There are a variety of factors that effect insurance costs like age of equipment, commodities, hauls, radius, vehicle location, loss history, and your years in business. Here are some examples of common coverage’s you’ll want to make sure your insurance policy has covered:

This coverage protects the trucking business against any property damage or bodily injury that might occur without the presence of a truck. This policy is there to keep your company afloat in case of major accidents like a client slipping and falling in your office, a load getting delivered to the wrong place, or contractual exposures you may be involved in.

This coverage pays for an accident when the truck driver is not under dispatch.

This coverage is for if you are required to have a policy in place for when your truck is operating without a trailer. This coverage pays for the damages or injuries caused while the trailer is detailed from your truck, whether or not you are dispatched on a job.

Cargo

This covers the damaged or losses to freight that is in-transit from any external cause. This policy will pay regardless of which carrier is ultimately at fault. Damages that are covered include: inappropriate packing, infestation, cargo abandonment, customs rejection, and employee’s dishonesty.

Physical Damage Coverage

This covers damages to your truck and trailer that result from an accident you are not liable for. Your premium is based on the value of your equipment. Damages that are covered: collision, overturn, or natural disaster, even if you experience total loss.

Next step for your trucking business

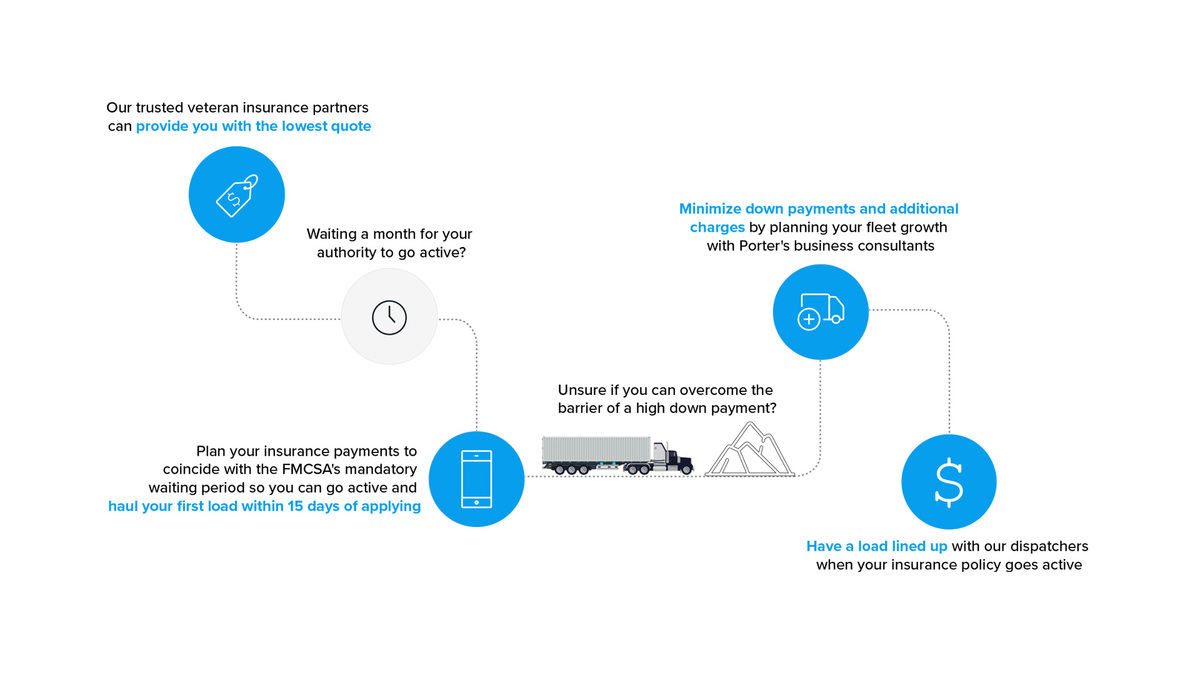

Once you have filed for your motor carrier authority, you have 21 days to get an insurance policy and file your BOC-3. You are not authorized to start driving your truck and operating your trucking company until your MC number active and your BOC-3 and Insurance Policy are filed with the FMCSA.

Importance of Choosing the Right Commercial Vehicle Insurance

Finding the right owner operator truck insurance is vital to ensure the success of your business. When comparing policies, it’s essential to find a provider that offers the coverage you need along with advice and tips to support you and your company. Additional reasons to ensure you have the right coverage include:

- Legal requirements: Commercial vehicle insurance is legally required. If you’re operating without the proper owner and operator insurance coverage, you may face legal actions and significant fines. You may also face a penalty that impacts your ability to continue business operations.

- Business expense: Your commercial insurance policy is likely one of the largest expenses your business will pay each year. Choosing the right policy can also help your business to financially recover after an accident. Selecting a customized policy will balance coverage with costs for a cost-effective option.

- Coverage beyond accidents: While it’s essential to choose an insurance option that covers expenses in a motor vehicle accident, there are many other aspects of a commercial truck insurance policy. Most policies will cover damage to your truck and other parties’ vehicles in an accident. When choosing coverage, make sure it protects your specific needs to get the most value.

- Additional services: Depending on your insurance policy, you may be eligible for services such as roadside assistance, fuel delivery and navigation assistance.

- Protect your business: The right insurance policy will protect your business from financial difficulty due to events like theft or accidents. Choosing the right owner and operator insurance policy will also maintain your company’s reputation as a trustworthy service. An experienced insurance professional helps you return to normal operations after an accident as well and further cements your company as a reliable service.

How to Reduce Your Insurance Premium

While commercial trucking insurance is a required expense for all trucking companies, there are ways to reduce your premium without seeing a reduction in coverage. Since insurance providers consider a variety of factors when determining your premium, knowing owner and operator insurance requirements will help you secure a lower price.

Ways you can lower your insurance rate include:

- Hiring drivers with experience.

- Employing drivers with histories of clean driving.

- Verifying employment history.

- Mapping out routes beforehand.

- Investing in your equipment.

One of the best ways to ensure you’re getting the best rate is to partner with Porter Freight Funding. Our team will work to ensure you’re receiving reliable coverage at cost-effective prices.

Contact Us for a Quote Today

We partner with insurance companies to get you the best quote for your business. Call (205) 397-0934 to learn more about our services or complete our online contact form to request an owner operator insurance quote!